Understanding The Indiana Department Of Revenue: A Comprehensive Guide

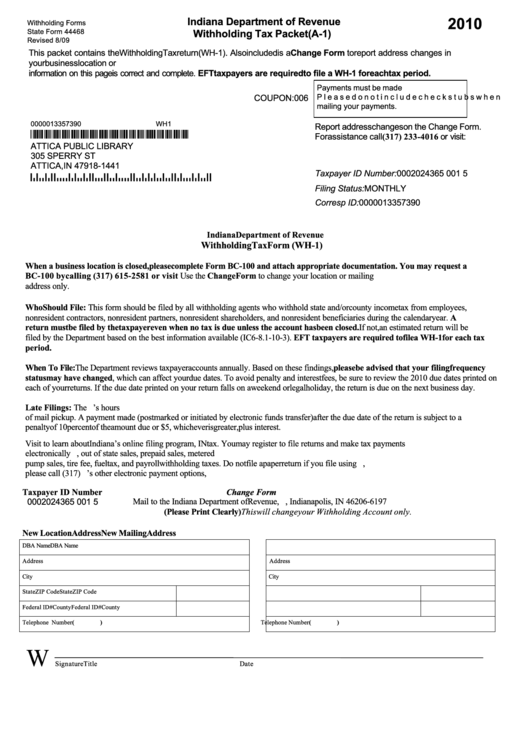

The Indiana Department of Revenue is a pivotal entity in the state’s financial ecosystem, tasked with the responsibility of collecting taxes, enforcing tax laws, and ensuring compliance among residents and businesses alike. Established with the aim of maintaining the state’s fiscal health, this department plays a crucial role in funding essential services such as education, infrastructure, and public safety. By centralizing tax administration, the Indiana Department of Revenue ensures a streamlined process that benefits both the taxpayers and the state government.

For many residents, interacting with the Indiana Department of Revenue can be daunting, given the complexities of tax regulations and compliance requirements. However, understanding its functions and services can help demystify the process, making it easier for individuals and businesses to navigate their tax obligations. This guide explores various aspects of the department, providing insights into its operations, services, and the significance of tax compliance.

From individual tax returns to business tax regulations, the Indiana Department of Revenue encompasses a wide array of responsibilities. Whether you are a seasoned taxpayer or a newcomer to Indiana, familiarizing yourself with the department's resources can empower you to make informed decisions regarding your finances. Let’s delve deeper into the Indiana Department of Revenue and uncover its vital role in the state’s economic framework.

- Avatar Flight Of Passage An Immersive Experience In Pandora

- Jack Of All Trades Full Quote And Its Meaning Explained

What Are the Main Functions of the Indiana Department of Revenue?

The Indiana Department of Revenue primarily serves to:

- Administer state tax laws and regulations.

- Collect various types of taxes, including income, sales, and property taxes.

- Provide taxpayer assistance through resources and support services.

- Conduct audits and enforce compliance among taxpayers.

How Does the Indiana Department of Revenue Assist Taxpayers?

The Indiana Department of Revenue offers numerous resources and services to assist taxpayers, including:

- Online filing options for individual and business tax returns.

- Access to forms and instructions for various tax obligations.

- Customer service support through phone and in-person consultations.

- Educational resources and workshops to enhance tax literacy.

What Are the Various Taxes Managed by the Indiana Department of Revenue?

The Indiana Department of Revenue manages several types of taxes, including:

- Understanding Phantom Tax Meaning What You Need To Know

- Is Rainbow Six Siege Crossplay A Comprehensive Guide

- Individual Income Tax: Collected from residents and non-residents earning income in Indiana.

- Sales Tax: Imposed on the sale of goods and services in the state.

- Corporate Income Tax: Levied on the income of corporations doing business in Indiana.

- Property Tax: Assessed on real property and used to fund local services.

Why Is Tax Compliance Important in Indiana?

Tax compliance is essential for various reasons:

- Ensures the state has adequate funding for essential services.

- Avoids penalties and interest on unpaid taxes.

- Promotes a fair and equitable tax system for all residents.

- Supports the overall economic development of Indiana.

What Resources Are Available for Taxpayers Through the Indiana Department of Revenue?

Taxpayers can access a variety of resources, including:

- Official website with downloadable forms and guides.

- Online payment options for ease of transaction.

- FAQs and troubleshooting tips for common tax issues.

- Workshops and seminars focused on tax education.

How Can Businesses Interact with the Indiana Department of Revenue?

Businesses have specific interactions with the department, which include:

- Registering for a state tax identification number.

- Filing business tax returns and paying corporate taxes.

- Staying informed about tax law changes that affect business operations.

- Utilizing resources for tax planning and compliance assistance.

What Are the Consequences of Failing to Comply with Indiana Tax Laws?

Failure to comply with Indiana tax laws can lead to serious consequences such as:

- Imposition of fines and penalties.

- Accrued interest on unpaid taxes.

- Potential legal action by the Indiana Department of Revenue.

- Loss of business licenses or permits in severe cases.

How Can You Contact the Indiana Department of Revenue?

Taxpayers can reach out to the Indiana Department of Revenue through various channels:

- Phone: The department offers dedicated hotlines for taxpayer inquiries.

- Email: Taxpayers can send queries via email through the department’s official website.

- In-person: The department has office locations where taxpayers can receive assistance.

In conclusion, the Indiana Department of Revenue serves as an essential institution in the state, managing tax collection and compliance for residents and businesses alike. By understanding its functions, resources, and the importance of tax compliance, taxpayers can navigate their obligations more effectively and contribute to the financial health of Indiana. Whether you are an individual filing your income tax return or a business managing corporate taxes, the Indiana Department of Revenue is there to ensure a smooth process and support your financial responsibilities.

Detail Author:

- Name : Prof. Eldred Boyer

- Username : tthompson

- Email : qdaniel@streich.info

- Birthdate : 1986-06-18

- Address : 88683 Russel Trace Suite 983 Franzville, TN 05792-0262

- Phone : (386) 923-8826

- Company : Gorczany-Rosenbaum

- Job : Food Service Manager

- Bio : Qui delectus animi earum. Explicabo iusto quas quibusdam.

Socials

tiktok:

- url : https://tiktok.com/@nikita7501

- username : nikita7501

- bio : Et commodi nihil vero et aspernatur mollitia at. Qui et ratione pariatur.

- followers : 841

- following : 1668

linkedin:

- url : https://linkedin.com/in/nikitakuhic

- username : nikitakuhic

- bio : A id minus libero et laborum nostrum nisi minus.

- followers : 263

- following : 1192

instagram:

- url : https://instagram.com/nikita.kuhic

- username : nikita.kuhic

- bio : Impedit nam et corrupti culpa quia nisi totam. Hic soluta velit sunt. Eaque eos aspernatur et.

- followers : 6567

- following : 234